Referential and Reviewed International Scientific-Analytical Journal of Ivane Javakhishvili Tbilisi State University, Faculty of Economics and Business

Tendencies and Prospects for Developing the World Economy and Post-Soviet Economies by Incorporating Geopolitical Shock Around Ukraine

The article presents a vision towards the current trends and prospects for the development of the world economyand economies of countries in the post-Soviet space by taking into account the influence of macroeconomic and political factors, including the geopolitical crisis witnessed around Ukraine. Attention is focused on the need to strengthen the financial stability of countries and regions, taking into account the influence of negative factors.

The article analyzes the trends and prospects for the development of the world economy, the economies of countries in the post-Soviet space, taking into account the influence of macroeconomic and political factors, including the geopolitical crisis around Ukraine. Attention is focused on the need to strengthen the financial stability of countries and regions, taking into account the influence of negative factors.

Keywords: World economy, post-Soviet economies, economic growth rates, inflation, savings and investments, budget deficit, public debt, balance of payments.

JEL Codes: H62, H63, O47, P24, P44

Introduction

The global economy as a whole, the economies of regions and individual countries are currently being affected by a number of significant negative factors: the threat of a global recession, high inflation (primarily due to rising energy prices), incompletely restored global economic ties after the COVID-19 pandemic, trade wars, economic sanctions, etc. In addition, a significant increase of central bank interest rates was witnessed that was aimed at curbing inflation in 2022. Thus, the interest rate set by the Federal Reserve System was increased from 0.3% to 4.5% during 2022, while the European Central Bank increased it from 0 to 2.5%. Such a noticeable increase in the rates of the central banks of the leading countries of the world is, to a certain extent, a shock to the world economy, since for many years after the global crisis of 2007-2008. it has adapted to a policy of very cheap money.

And, finally, a very important, if not the determining negative factor in the development of the world economy, has been and remains to be the geopolitical shock around Ukraine. Although there are many other serious geopolitical conflicts besides it, e.g. tensions in US-China relations, conflicts over Syria and Afghanistan; they also negatively affect the economic development of countries and regions. The factor of geopolitical conflicts, especially the one around Ukraine, is currently gaining its strength and urgency. The world's leading politicians recognize the serious threats posed by this conflict.

Geopolitical realities have a complex impact on the world economy, their negative influence is manifested in the fragmentation of the world economy into political blocs of countries, in a certain sense, the destruction of global ties and potential, sanctions and trade wars, an increase in the imbalance of public finance, an increase in the number of refugees, social tension in many countries. Unfortunately, the geopolitical conflict around Ukraine has also led to direct hostilities, destruction of industrial, public and private buildings and infrastructure, and significant loss of life. Currently, the conflict around Ukraine is one of the main negative factors for the development of the world economy.

World economy, the economy of regions and countries are developing against this background and under the influence of the above factors, while the conflict over Ukraine has the greatest impact on the economy of the parties involved and the surrounding regions - European and post-Soviet.

Global Recession Being Avoided, Risks Still Remain

Situation in the global economy does not look too pessimistic at present despite the influence of these negative factors and the continued threat of recession in developed countries.

Situation is quite complicated at the same time, as many analysts, politicians and heads of international financial organizations spoke recently. For example, Kristalina Georgieva, Managing Director of the International Monetary Fund (IMF) made an announcementin July 2022 about a possibility of a global recession in the world economy in 2023. According to her, a slowdown in economic growth could be the “price to be necessarily paid” for restoring price stability.

Despite such forecasts, although global GDP growth significantly slowed down in 2022 (from 6% in 2021 to 3.4% in 2022), there are no clear signs of a global recession yet.

Global Gross Domestic Product (GDP) is likely to increase by 2.9% in 2023, thus being 0.2 percentage points higher than forecasted in October, as the IMF said in its quarterly global economic outlook update. While this is a slowdown from growth of 3.4% in 2022, the IMF said it expects growth to hit theground this year and then accelerate upwards to 3.1% in 2024.

At the same time, the growth of the global economy expected this year will be one of the lowest over the past two decades. It was lower only twice: during the global financial crisis and in the pandemic of 2020, as noted by Kristalina Georgieva, IMF Managing Director. The Fund refersto three main factors that will slow down the growth of the global economy in 2023: high inflation, increased interest rates and the consequences of the Russian military operation in Ukraine.

China's economic recovery that has begun includes a risk of demand for energy and raw materials to increase due to the growth of the Chinese economy, which could again spur higher prices for these goods.

Economic Stance in Developed Countries

The forecasts for a recession did not materialize in 2022 not only at the global level, but in developed countries, including the United States. The economy of developed countries grew by 2.7%in 2022, including the US economy - by 2%, the Eurozone - by 3.5% (including Germany - by 1.9%, France - by 2.6% , Italy - by 3.9%), United Kingdom - by 4.1%, Japan - by 1.4%. At the same time, the growth rates of the economies of developed countries, according to the IMF forecast, will slow down to 1.2%this year, including in the USA - up to 1.4%, in the Eurozone countries - up to 0.7%, and production in the UK is expected to decline by 0.6%. Thus, although the recession predicted earlier by a number of analysts in developed countries did not occur in 2022. Nevertheless, modest economic growth forecasts indicate a continuing threat of recession in 2023.

Against the backdrop of good production growth rates in developed countries in 2022, the unemployment rate also decreased from 5.6% to 4.5% according to the IMF (including the countries in the Eurozone - from 7.7% to 6, 8%). At the same time, according to IMF forecasts, unemployment in the group of developed countries will grow to 5% in 2023, including in the Eurozone - up to 7%. In 2022, according to this indicator, the situation in developed countries varied greatly. Thus, the unemployment rate was 3.4% in the USA, 2.6% in Japan, 3.8% in the UK, 2.9% in Germany, 7.5% in France, 8.8% in Italy, 12.7% in Spain, 3.5% in the Netherlands. At the same time, against the backdrop of weakening economic growth witnessed in 2023, the IMF predicts a moderate increase in unemployment in many developed countries.

Economic Advancement of Developing Countries

The economies of developing countries and countries with emerging markets as a whole grew by 3.9% in 2022, this year growth is expected at 4%.

The economies of developing Asian countries grew by 4.3% in 2022, this year the growth was 5.3%.

GDP increased by 3% in China in 2022, which is the lowest since 1976, except for the pandemic in 2020, when economic growth was only 2.2%. However, the IMF predicts a growth of the Chinese economy at the level of 5.2% in 2023. The acceleration of growth should be facilitated by the lifting of anti-COVID restrictions and a move away from strict regulation in the real estate market. In addition, China's economic and political role is growing in a number of countries and regions, in the context of the fragmentation of the global economy due to the geopolitical conflict around Ukraine. At the same time, geopolitical risks may make adjustments to this relatively optimistic forecast. The unemployment rate in China, according to the IMF, against the backdrop of a weakening economic growth rose from 4% to 4.2% in 2022. A slight decrease is predicted (to 4.1%) in 2023.

The Indian economy showed good growth rates in 2022 at 6.8%. It will increase by 6.1% in 2023.

High growth rates in 2022 were shown by the countries of the Middle East and Central Asia (5.3%), which was largely facilitated by a nice set of prices for energy and other commodities. This year, the IMF predicts a more modest growth of 3.2%.

The economies of Latin America showed good growth of 3.9% in 2022, although according to IMF forecasts, growth will be more modest at 1.8% this year.

Very modest growth was observed in the group of European countries with emerging markets at only 0.7% in 2022, which is to some extent due to the negative impact of the geopolitical conflict around Ukraine; in particular, the high cost of energy, sanctions and the disruption of trade and economic relations with countries involved in the conflict. The IMF expects economic growth in this group of countries at the level of 1.5% in 2023.

In countries of the post-Soviet space, the dynamics of GDP varied greatly by country. Nations actively involved in the conflict over Ukraine experienced a drop in GDP. Thus, the GDP of Ukraine decreased by almost 33%at the end of 2022, Belarus - by 4.7%, Russia - by 2.1%. Zero GDP growth is expected by the IMF in Moldova in 2022. At the same time, the dynamics of the GDP of many post-Soviet countries was at a fairly high level in 2022: the economy of Azerbaijan grew by 4.6%, Armenia - by 14.2%, Georgia - by 10.1%, Kazakhstan - by 3, 1%, the Kyrgyz Republic - by 7%, Tajikistan - by 8%, Turkmenistan - by 6.2%, Uzbekistan - by 5.7%.

The unemployment rate in the post-Soviet countries also varied greatly. According to IMF estimates, this figure was 5.9% in Azerbaijan in 2022, 15.2% in Armenia, 4.5% in Belarus, 4.9% in Kazakhstan, 9% in the Kyrgyz Republic, Moldova - 3.5%, in Russia - 4%, in Uzbekistan - 10%. There is no data for Ukraine, although the difficult situation in the country and the massive decline in the economy suggests that the unemployment rate is also high.

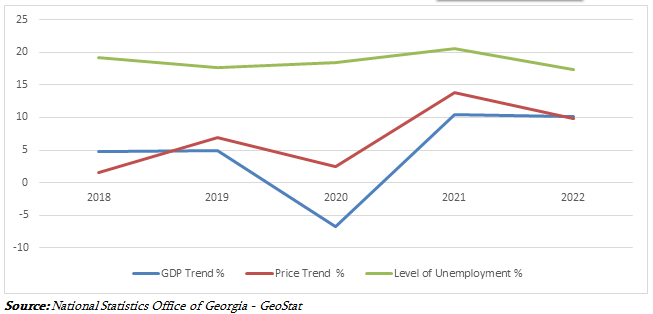

Georgia: High Economic Growth and Slow-Down of Inflation

The Georgian economy has been showing double-digit growth for 2 years in a row,Although, similar to almost all countries in the context of the COVID-19 pandemic, Georgia experienced a decline in production in 2020 (Fig. 1).

The improvement of the macroeconomic situation in Georgia was also reflected in the assessment of international rating agencies. In January 2023, the leading international rating agency Fitch changed the outlook on Georgia's long-term Issuer Default Rating (IDR) in foreign currency from Stable to Positive and confirmed the IDR at the level of "BB". Ratings agency Fitch notes that the Positive outlook partly reflects very strong GDP growth, an increase in international reserves and an outperforming budget in 2022, driven by a recovery in tourism, as well as a large influx of migrants and capital from Russia. At the same time, macroeconomic fiscal policy remained prudent, with relatively tight monetary policy, spending containment and strong revenues helping to narrow the budget deficit and sharply reduce public debt relative to GDP in 2022.

In addition, with significant economic growth, inflation was brought under control and even reduced from 12-13% to 9.4%.

Foreign trade volumes increased significantly: from 14.342 MLN GEL in 2021 to 19.110 MLN GEL in 2022.

The volume of goods registered for export increased from 4 243 MLN GEL in 2021 to 5 593 MLN GEL in 2022 or by 31.8%. If we talk about the structure of Georgian exports by destination, the most important trading partners were Russia (19.1% share in exports), Armenia (15.2%), Azerbaijan (11.3%), Kazakhstan (7.2%) and China (6.9%) as of January 2023.

The volume of goods imported to Georgia amounted to 13 517 MLN GEL in 2022, which is 33.8% higher than in 2021. The structure of Georgian imports by countries of origin was dominated by Russia (17.5%), Turkey (16.4%), Azerbaijan ( 6.8%), China (6.5%) and Germany (6.3%).

As evidenced by the structure of exports and imports broken down by trading partners, there is a strong dependence on trade relations with neighboring countries, including those involved in the conflict over Ukraine. Therefore, although the situation in the field of foreign trade is so far developing very well, which has a positive effect on the entire economy of Georgia, in the event of an escalation of the geopolitical conflict, risks increase both for foreign trade and for the Georgian economy as a whole.

Unemployment rate was 17.3% in Georgia in 2022, which is noticeably lower than in 2021 (20.6%). Some 220 000 jobs were created in Georgia last year, large-scale economic projects are planned and are being implemented.

Trend of Most Significant Macroeconomic Indicators of Georgia, in Percentage Terms

Figure 1.

Banking Sector of Georgia in the Conditions of Growing Geopolitical Risks

Multidirectional trends were witnessed in the banking sector of Georgia in 2022. Undoubtedly, the increased macroeconomic and geopolitical risks also had an impact on the Georgian banking sector.

The assets of the banking sector of Georgia increased from 60.6 BLN GEL in 2022 to 70.3 BLN GEL, or by 16%, which in general indicates a fairly dynamic development of the banking system. At the same time, deposits of legal entities (except banks) and individuals placed at banks increased from 37.2 BLN GEL to 44.3 BLN GEL, or by 19% in 2022.

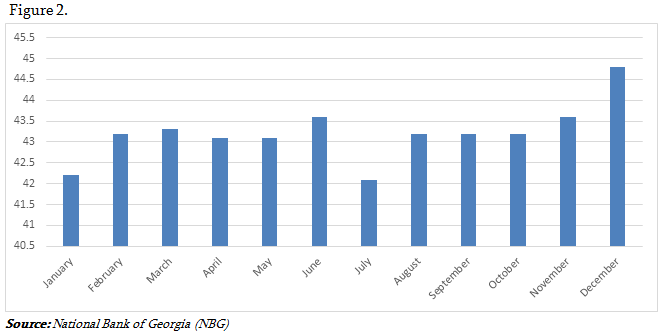

The loan portfolio of Georgian banks increased from 43.1 BLN GEL to 44.8 BLN GEL, or by 3.9% in 2022 (Fig. 2), while loans contracted in January, March and June. The level of provisioning for possible losses on loans during the year did not change significantly and fluctuated in the range of 1.8-2.0 BLN GEL, thus there was no significant build-up of additional provisioning, which evidenced the absence of a significant increase in credit risks.

Capital base of the banking sector of Georgia strengthened significantly in 2022. The total capital of banks increased from 7.7 BLN GEL to 9.2 BLN GEL, or by 19.5%.

The financial results of the activities of Georgian banks in difficult macroeconomic conditions do not look bad either. The total pre-tax profit of Georgian banks increased from 2,157MLN GEL to 2,859MLN GEL in 2022, or by 32%. The return on assets of the banking sector slightly decreasedin 2022: from 3.6% to 3.2%. The return on equity (ROE) decreased as well: from 30.4% to 24.6%. The decline in profitability is to some extent due to the high growth rates of capital and assets.

In general, the banking system of Georgia remains stable and demonstrates good development, although it should be remembered that the economy and the financial sector are heavily dependent on geopolitical risks.

Loan Portfolio Trends in Georgian Banks in 2022, BLN GEL

Inflation in the Global Economy is Slowing Down

According to IMF estimates, inflation rates in the global economy are slowing down. The Fund forecasts global consumer price growth to slow down to 6.6% in 2023 after rising 8.8% in 2022. Inflation in 84 countries of the world is expected to be lower in 2023 than in 2022. Meantime, IMF officials claim that the fight against inflation has not yet been won: monetary policy must remain contractive and some countries need to intensify their fight against inflation.

IMF predicts decline in savings and investment; Economic growth directly depends on the level of savings and investment. According to the IMF, the global economy saw an increase in both savings and investment in 2022. In particular, the level of savings amounted to 29% of GDP in 2022 (28.4% of GDP in 2021), while investments - 28% of GDP (27.1% of GDP in 2021). Slight decrease in the level of savings and investment is forecasted in 2023 - to 27.8% and 28.8%, respectively.

In developed countries, the level of savings and investment also grew and reached 23.8% and 23% in 2022. These figures are expected to decline slightly in 2023 - to 23.7% and 22.6%, respectively.

At the same time, the level of savings decreased from 26.6% of GDP to 24.7% of GDP in the Eurozone in 2022, which indicates a decrease in the investment potential of the countries of this group. Moreover, the IMF predicts a further decrease in this indicator in 2023 - to 24.5% of GDP. The level of investment in the Eurozone increased slightly in 2022: from 23% to 23.2% of GDP, in 2023 this indicator is projected to decrease to 22.5% of GDP, which creates conditions for lower economic growth and higher unemployment. A decrease in the level of investment in general also indirectly indicates a deterioration in the investment climate. Of course, the participation of European countries in a geopolitical conflict reduces their investment attractiveness and increases the risks of long-term investments. A decent level of inflation, rising prices for raw materials and energy carriers, and the disruption of economic ties due to the war of sanctions do not contribute to investment.

In the group of developing countries and emerging markets, both savings and investments grew in 2022, despite the influence of negative factors. So, the level of savings in this group of countries increased from 34% of GDP to 35.4% of GDP in 2022, while the level of investment - from 33.3% to 34.3% of GDP.

In developing Asian countries, savings increased from 40.2% to 41.8% of GDP in 2022, while the investments - from 39.2% to 41.1% of GDP. Thus, this region is still the locomotive of the world economy and it largely prevents a global recession. At the same time, the IMF expects these indicators to decrease to 41.4% and 40.8% of GDP in 2023.

In China, savings increased from 44.4% to 46.4% of GDP in 2022, while investments - from 42.6% to 44.8% of GDP, which indicates the growth of the economic potential of the Chinese economy even in conditions of increased economic and geopolitical risks. At the same time, the IMF predicts that savings in the Chinese economy will decrease to 45.7% of GDP in 2023, while investments - to 44.5% of GDP.

Savings in India decreased from 30% to 29.4% of GDP in 2022, while investments - on the contrary - increased from 31.2% to 32.8% of GDP. The IMF predicts an increase in both savings and investments in this country up to 30.1% and 33% of GDP in 2023, respectively. India is becoming one of the most dynamically developing countries in the world.

Savings in emerging European economies rose from 25.8% to 27% of GDP in 2022, while investments remained almost unchanged at about 24% of GDP. The IMF predicts a slight decrease in these indicators in 2023 - to 26.4% and 23.7% of GDP, as in the whole world.

Savings in Latin American countries remained unchanged at about 19% of GDP in 2021-2022, while the level of investments increased from 20.4% to 20.8% of GDP in 2022. At about the same level, the IMF predicts savings and investments in these countries in 2023.

Savings in the countries of the Middle East and Central Asia increased considerably: from 30.2% to 33.9% of GDP in 2022, while the level of investments - on the contrary - fell from 28.4% to 27.8% of GDP. This year, the IMF predicts a decrease in the level of savings to 33% and an increase in the level of investments - up to 28.3%.

If we look at the situation of savings and investments in countries of the post-Soviet space, it can be noted that savings in Azerbaijan have increased significantly - from 31.8% to 45.4% of GDP in 2022, according to the IMF; decreased from 12.9% to 11.6% of GDP in Armenia, fell significantly (from 28.3% to 22.4% of GDP) in Belarus, increased from 11.9% to 12.6% of GDP in Georgia, increased from 23.3% to 27.8% of GDP in Kazakhstan, significantly decreased (from 16.9% to 11.7% of GDP) in Kyrgyz Republic, fell from 17% to 15.6% of GDP in Moldova, increased from 29.2% to 32.6% of GDP in Russia, decreased from 17% to 14.9% of GDP in Tajikistan, while no data is available for Turkmenistan, increased from 33.6% to 38.8% of GDP in Uzbekistan and no data is available again for Ukraine.

Trend of investments in the post-Soviet space in 2022 was as follows: decreased from 17.3% to 14.6% of GDP in Azerbaijan, increased from 16.6% to 17.1% of GDP in Armenia, decreased from 25.6% to 23.8% of GDP in Belarus, decreased from 22% to 19.8% of GDP in Georgia (with an increase in direct investments from 1 242 MLN GEL to 1 676 MLN GEL, or by 35%), decreased from 26.2% to 24.9% of GDP in Kazakhstan, decreased from 25.5% to 24.2% of GDP in Kyrgyz Republic, slightly decreased (from 28.7% to 28 55 of GDP) in Moldova, decreased from 22.4% to 20.1% of GDP in Russia, fell from 17% to 14.9% of GDP in Tajikistan, while no data is available for Turkmenistan, increased from 40, 6% to 42.1% of GDP in Uzbekistan and no data available again for Ukraine.

Thus, a decrease was observed in the level of investments in most countries of the post-Soviet space in 2022, which obviously reflects a decline in the investment attractiveness of this region, inter alia due to the geopolitical conflict around Ukraine. At the same time, a very high level of investment and the positive trend of this indicator could be noted in Uzbekistan.

Public Finance

Influence of negative factors, including the geopolitical crisis around Ukraine, could not but affect the state of public finance in many countries. On the one hand, there was an increase in government spending: military, social, including in connection with the mass migration of the population, to support sectors of the economy and help many enterprises, the population in the conditions of a sharp rise in prices for energy, electricity and commodities. On the other hand, the economic problems of enterprises, sanctions, the disruption of economic ties adversely affected the revenues collected to the state budgets. In such conditions, many countries maintained a chronic state budget deficit, a high amount of public debt and the amount of debt reached very high values in a number of countries, which still potentially threatens the financial stability of countries and regions, the global economy as a whole.

At the same time, a group of developed countries managed to move away from the record-high state budget deficit in the pandemic years of 2020-2021, despite the negative impact of the geopolitical conflict around Ukraine (10.4% and 7.2% of GDP). According to the IMF, this indicator amounted to 3.7% of GDP in 2022, while it is predicted that the deficit will remain at the level of 2022 in 2023.

In the countries of Eurozone, the budget deficit has also been shrinking from 7.1% of GDP in 2020 to 5.1% of GDP in 2021 and 3.8% of GDP in 2022. This year, the IMF predicts that the budget deficit will fall to 3.3% of GDP.

Developing countries and emerging markets have experienced high government deficit indicator in recent years. It reached 8.6% of GDP in 2020, 5.3% of GDP in 2021 and 6.1% of GDP in 2022. Deficit is projected at 5.4% of GDP this year.

One can note a significant increase in the budget deficit in the developing countries of Asia in 2022: from 6.5% to 8.5% of GDP. It will remain at the level of 7% in 2023.

Fiscal deficit widened from 1.8% to 3.4% of GDP in emerging European economies in 2022. It is expected to be 3.1% of GDP this year.

Budget deficit reached 4.2% of GDP in Latin American countries, while 4.5% of GDP in African countries.

In the states of the Middle East and Central Asia, the situation with the budget deficit as a whole does not look bad. So, if in 2020 this indicator reached 7.8% of GDP, it later decreased to 3.2% of GDP in 2021 and even managed to reach a positive budget balance of 0.2% of GDP in 2022. Budget deficit at 0.8% of GDP is projected for 2023. High energy prices played by far the last role in stabilizing the finance of this group of countries, which made it possible to significantly increase the flow of funds to the state budget.

Post-Soviet space experienced an increase in the budget deficit in a number of countries in 2022, including active participants in the geopolitical conflict around Ukraine. Thus, it increased from 1.7% to 4.3% of GDP in Belarus, from 0.4% to 3.3% of GDP in Kyrgyz Republic, from 2.6% to 6.2% GDP in Moldova, from a positive balance of 0.8% to 2.3% of GDP in Russia and from 0.7% to 2.5% of GDP in Tajikistan. At the same time, Azerbaijan had a budget surplus of 17.2%, Armenia reduced its deficit from 4.6% to 2.3% of GDP, Georgia reduced its deficit from 6% to 3% of GDP, Kazakhstan from 5% to 2% of GDP; budget surplus increased from 0.3% to 0.6% of GDP in Turkmenistan, while Uzbekistan reduced the deficit from 4.7% to 4% of GDP.

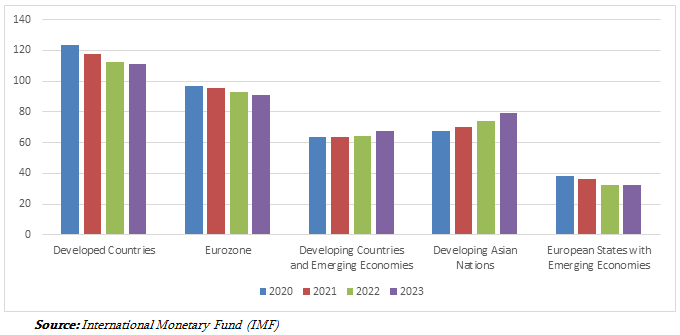

Despite the impact of a number of negative factors, including the geopolitical conflict around Ukraine, public debt did not increase significantly in most countries yet after a significant increase in the pandemic. In general, the amount of public debt is still under control in most countries; even a slight decrease is observed, although it is still at a very high level in many countries (Fig. 3).

In 2022, the public debt of developed countries reached 112.4% of GDP and 93% of GDP in the countries of Eurozone, which is much higher than the permitted level at 60% of GDP recommended by international organizations. The situation in terms of the size of debt of the state varies greatly among developed countries. So in 2022, the public debt in Austria reached 78.5% of GDP, Belgium - 103.9% of GDP, Canada - 102.2% of GDP, Cyprus - 93.6% of GDP, Finland - 66.7% of GDP, France - 111 .8% of GDP, Germany - 71.1% of GDP, Greece - 177.6% of GDP, Iceland - 68.2% of GDP, Italy - 147.2%of GDP, Japan - 263.9% of GDP, Portugal - 114.7 % of GDP, San Marino - 86.5% of GDP, Singapore - 141.1% of GDP, Slovenia - 69.5% of GDP, Spain - 113.6% of GDP, UK - 87% of GDP and USA - 122.1% of GDP.

The level of public debt of developing countries and economies in transition amounted to 64.5% of GDP in 2022.

Developing Asian countries had a public debt of 74.2% of GDP in 2022. At the same time, China's public debt has a clear upward trend: in 2020 this indicator reached 68.1%, in 2021 - 71.5% of GDP, in 2022 - 76.9% of GDP, in 2023 it is predicted at the level of 84.1% of GDP. India managed to reduce and stabilize the level of public debt, although it is still at a high level: in 2020 it was 89.2% of GDP, in 2021 - 84.2% of GDP, in 2022 - 83, 4% of GDP, it is expected that it will be at the level of 83.8% of GDP in 2023.

European countries with emerging markets had a public debt of 32.3% of GDP in 2022.

The public debt of Latin American countries amounted to 69.3% of GDP in 2022.

The countries of the Middle East and Central Asia had a public debt at the level of 43.4% of GDP in 2022.

Size of Public Debt by Groups of Countries, % of GDP

Figure 3.

In the post-Soviet space, the situation with the amount of public debt developed as follows: according to the IMF, despite the geopolitical conflict, Belarus managed to reduce the level of public debt from 41.2% to 35% of GDP in 2022, Russia - from 17% to 16.2% of GDP, there is no data available for Ukraine. In 2022, the public debt of Azerbaijan also decreased (from 26.5% to 20.7% of GDP), Armenia (from 60.3% to 53.2% of GDP), Georgia (from 49.5% to 39. 8% of GDP), Kazakhstan (from 25.1% to 23.3% of GDP), Kyrgyz Republic (from 61.1% to 60.4% of GDP), Tajikistan (from 44.4% to 39.4 % of GDP), Turkmenistan (from 11.1% to 8.4% of GDP), Uzbekistan (from 35.8% to 34.1% of GDP).Public debt increased in Moldova from 33.2% to 36% of GDP in 2022.

Net Balance Kept at the Current Account of the Balance of Payments

Balance of payments in developed countries again turned negative after several years of interruption in 2022 (at minus 0.7% of GDP), although the current account of the balance of payments was positive and amounted to 1% of GDP in the countries of the Eurozone. The positive balance of developing countries and economies in transition strengthened to 1.3% of GDP.

Multidirectional trends were noted in the post-Soviet space. Thus, according to the IMF, the current account deficit was observed in Armenia (5.6% of GDP), Belarus (1.5%), the Kyrgyz Republic (12.5% of GDP), Moldova (12.8%), Uzbekistan (3.3% of GDP) in 2022. There is no data for Ukraine.

At the same time, the current account surplus of the balance of payments was noted in Azerbaijan (31.7% of GDP), Russia (12.2%), Kazakhstan (3% of GDP), Tajikistan (3.9% of GDP) and Turkmenistan (2.5% of GDP) in 2022.

In Georgia, the negative balance of the current account of the balance of payments amounted to 7.2% of GDP in 2022, which is significantly less than in 2020 (12.5% of GDP) and in 2021 (10.1% of GDP), while the IMF predicts a further decline in the account deficit to 6.8% of GDP in 2023. The situation was improved interalia by the inflow of capital and funds from countries actively involved in the conflict.

World Trade

Negative macroeconomic and political factors, including those related to the geopolitical crisis around Ukraine (e.g. sanctions), had a negative impact on world trade volumes. Thus, world trade as a whole (goods and services) grewby 4.3% in 2022 according to the IMF, while in 2021 the growth was 10.1%, while the average growth rate of this indicator was 5.4% in 2004-2013. Growth rate of world trade will be at the level of 2.5% in 2023 according to the IMF forecast. At the same time, exports from developed countries increased by 4.2% in 2022 and imports - by 6%, whilethe increase grew by 3.3% and 2.4% respectively from developing countries.

Conclusion

Thus, an analysis of the economic development of the world economy with various groups and countries therein, including states in the post-Soviet space, shows mixed results for 2022.

While the world economy has managed to avoid a crisis and recession on the one hand, the price tag is still declining in most countries, while the state budget deficit and public debt are under control.

On the other hand, a slowdown in economic growth is predicted in 2023, but the level of savings and investment is still declining in many countries, including the largest ones; public debt is at a very high level, threatening the macroeconomic and financial stability of both these countries and the global economy.

There are many uncertainties regarding geopolitical risks, in particular, the development of a geopolitical conflict around Ukraine. Escalation of the conflict is plausible, along with an involvement of new countries in hostilities, man-made and humanitarian disasters. With an unfavorable development of events, unstable macroeconomic and financial stability will be under a question mark in the global economy, regions and countries.

If we talk about countries in the post-Soviet space, since hostilities are taking place in this region, the participants of the military conflict experience the greatest negative impact: there is a recession in the economy with rising prices, increased government spending and instability of national currencies. At the same time, some countries in the post-Soviet space managed to improve the domestic macroeconomic situation, including through the inflow of capital, financial resources and labor from countries participating in the conflict and the growth of foreign trade.

The uncertainty of the situation with the development of the geopolitical conflict around Ukraine threatens the countries in the post-Soviet space to a greater extent. Therefore, in addition to actively seeking a peaceful solution to the conflict, it is very important to create a "safety cushion" in the economy and financial sector, forming reserves at the state level and withinenterprises, conducting stress-testing at enterprises and financial companies to identify "bottlenecks", developing anti-crisis plans. In the context of geopolitical conflict, it is very important to prevent further increase in the fragmentation of the world economy and its destruction. Preventing the escalation of the geopolitical conflict around Ukraine and its reasonable resolution remains the most important condition for the ultimate progressive development of both the world economy as a whole and individual regions and countries in particular.

References:

• Kovzanadze I. (2021) World Economy: Economic Implications of the COVID-19 Crisis and Prospects for Recovery. “Economic and Business” Tbilisi,Vol. XIII, N3.

• Kovzanadze I. (2020) Economic Challenges during COVID-19 and Post-Pandemic Era. “Economic and Business” Tbilisi, Vol. XII, N4.

• Kovzanadze I. (2018) “Global Economy: Post-Crisis to Sustainable Development” iUniverrse Inc. New-York, Bloomington.

• Kovzanadze I. (2010) “Systemic and Borderline Banking Crises: Lessons Learned for Future Prevention” iUniverrse Inc. New-York, Bloomington.

• www.geostat.ge

• www.nbg.gov.ge

• www.mof.ge

• www.imf.org

• www.bls.gov

• www.bea.ge

• www.fred.stlouisfed.org

• www.ebrd.com

• www.worldbank.org